Metropolitan Family Services FY23 Financials

STATEMENT OF ACTIVITIES

Years Ended June 30, 2023 and 2022

Amounts in 000’s

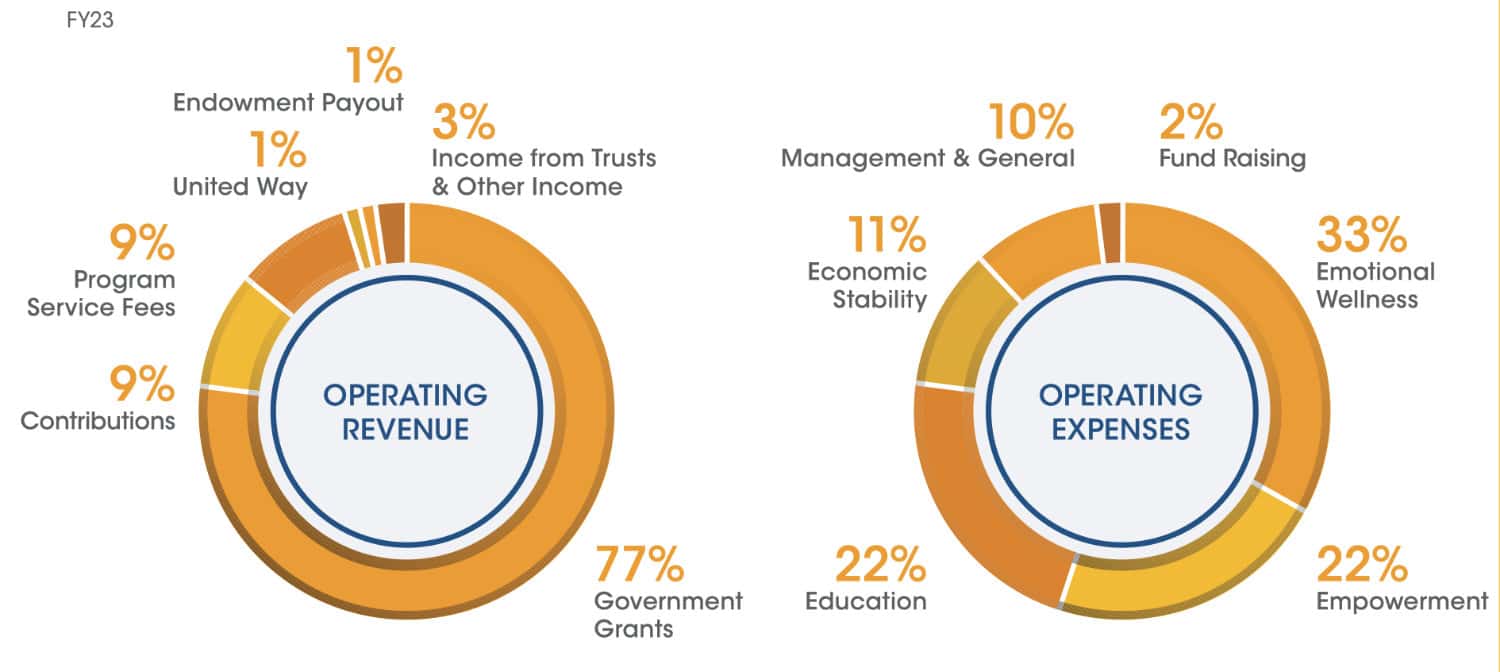

| OPERATING REVENUE | 2023 | 2022 |

| Government Grants | 99,243 | 79,921 |

| Program Service Fees | 11,146 | 8,273 |

| Contributions | 11,760 | 11,518 |

| United Way | 1,382 | 1,403 |

| Endowment Payout | 1,668 | 1,668 |

| Income from Trusts & Other Income | 3,959 | 4,724 |

| TOTAL OPERATING REVENUE | 129,158 | 106,907 |

| OPERATING EXPENSES PROGRAM EXPENSES | 2023 | 2022 |

| Emotional Wellness | 42,694 | 30,599 |

| Empowerment | 28,195 | 27,301 |

| Education | 27,500 | 23,910 |

| Economic Stability | 14,556 | 12,744 |

| Total Program Expenses | 112,945 | 94,554 |

| Management & General | 13,131 | 10,461 |

| Fund Raising | 2,724 | 2,398 |

| TOTAL OPERATING EXPENSES | 128,800 | 107,413 |

| OPERATING SURPLUS (DEFICIT) | 358 | (506) |

| OTHER CHANGES IN NET ASSETS | 2023 | 2022 |

| Depreciation & Amortization | (1,218) | (862) |

| Net Investment Gains (Losses) | 2,663 | 11,995 |

| Change in Pension Liability | 594 | 4,354 |

| Change in Market Value of Interest Rate Swap | 778 | 1,011 |

| PPP Loan | 0 | 0 |

| Inherent Contribution of HACC | 3,279 | 0 |

| Inherent Contribution of I-Grow | 0 | 2,988 |

| Transfer of Assets of I-Grow | (2,868) | 0 |

| Capital Grants | 2,783 | 2,452 |

| Release of Restiction | 1,243 | (797) |

| NON OPERATING ACTIVITY | 7,254 | 5,011 |

| TOTAL CHANGE IN NET ASSETS | 7,612 | 4,505 |

| NET ASSETS AT BEGINNING OF YEAR | 78,407 | 73,902 |

| NET ASSETS AT END OF YEAR | 86,019 | 78,407 |

| Contribution for Goods and Services | 4,236 | 3,245 |

BREAKDOWN OF EXPENSES

FY23

STATEMENT OF FINANCIAL POSITION

June 30, 2023 and 2022

Amounts in 000’s

| ASSETS | 2023 | 2022 |

| Cash | 15,324 | 12,220 |

| Receivables | 28,247 | 20,758 |

| I-Grow assets | 0 | 2,988 |

| Investments | 44,259 | 42,253 |

| Interest in trusts | 17,231 | 16,656 |

| Property and equipment | 31,690 | 22,477 |

| Construction work in Progress | 0 | 3,494 |

| Lease ROU Asset | 10,325 | |

| Other | 1,448 | 1,072 |

| TOTAL ASSETS | 148,524 | 121,918 |

| LIABILITIES AND NET ASSETS | 2023 | 2022 |

| Accounts payable and accruals | 13,147 | 11,218 |

| Investment Bond | 8,500 | 2,500 |

| NMTC Notes | 10,368 | 10,317 |

| Bonds payable | 12,700 | 12,700 |

| Pension liability | (49) | 544 |

| Lease Liability | 10,541 | |

| Other | 7,298 | 6,232 |

| TOTAL LIABILITIES | 62,505 | 43,511 |

| NET ASSETS | 86,019 | 78,407 |

| TOTAL LIABILITIES AND NET ASSETS | 148,524 | 121,918 |